How influencers are delivering results for India’s quick comm giants

The intense quick comm race has been unfolding not only on roads but also on social media platforms where leading players are battling it out for engagement

The intense quick comm race has been unfolding not only on roads but also on social media platforms where leading players are battling it out for engagement

The quick commerce industry in India is racing ahead, fuelled by the ever-evolving needs of urban consumers who demand convenience, speed, and accessibility. This high-stakes competition among leading players like Zepto, Blinkit, and Swiggy Instamart isn’t just playing out on roads and in delivery kitchens; it’s heating up on social media too.

Industry estimates that these three q-comm giants collectively spend between ?2 crore and ?10 crore on influencer marketing , with smaller players like Dunzo and others adopting similar strategies.

Marketing experts also revealed that quick commerce brands strategically allocated 10–20% of their advertising budgets to influencer marketing in 2024.

Zepto spent an estimated ?2–5 crore, focusing on selective partnerships and cost-effective campaigns to optimise reach and engagement. Similarly, Blinkit invested ?2–4 crore, balancing organic content with strategic collaborations to strengthen its brand presence. Swiggy Instamart, leveraging its larger scale and broader audience, allocated ?5–10 crore, channeling resources into prominent yet calculated influencer partnerships .

Krisneil Peres, Co-Founder and Chief Visionary Officer at Fame Keeda, notes, “Social media marketing, including digital ads, boosted posts, and influencer collaborations (both paid and barter), constitutes a significant portion of the marketing budget for quick commerce platforms. In 2025, influencer marketing budgets could range between 25–30% of the total amount for such platforms.”

Swiggy Instamart, Zepto, Blinkit: Who Leads the Pack?

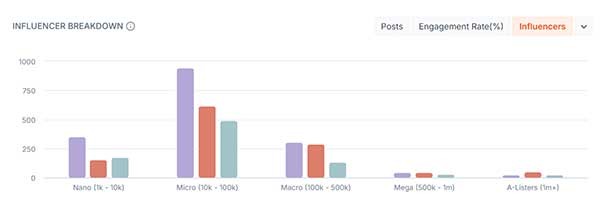

According to the exclusive Qoruz Competition Analysis report, Blinkit leads in the number of influencer collaborations, working with 1.7K creators, followed by Swiggy Instamart at 1.2K and Zepto at 851. Each brand, however, adopts a unique influencer mix.

Blinkit heavily relies on micro-influencers (10K–100K followers), clocking 1.4K posts in this category. Swiggy Instamart takes a balanced approach, achieving its highest engagement with A-listers (1M+ followers) at 5.82%. Zepto’s secret weapon are nano-influencers (1K–10K followers), who drive a whopping 9.82% engagement rate, proving that smaller creators pack a punch.

The payment per post varies widely depending on the nature of the collaboration. For micro-influencers, typical rates range between ?5,000–?15,000 per post, with collaborations often finalized in bulk to ensure comprehensive coverage. On the other hand, macro or mega influencers may charge upwards of ?35,000 per post, reflecting their broader reach and influence.

Source: Qoruz (Blinkit- purple, Swiggy Instamart-red, Zepto-Green)

Robin Thomas, Lead - Strategic Partnerships and Growth at White Rivers Media, explains, “By blending broad reach with niche influence, platforms are rewriting the rulebook on modern consumer engagement. Mega-influencers spark nationwide awareness, while micro-influencers ignite trust within close-knit communities. This dual strategy doesn’t just connect—it converts.”

Peres adds, “Influencers have become a great medium to broadcast a variety of products to a niche community of audiences, which makes them popular among all sorts of brands. Premium and luxury marketing traditionally has been extremely costly and tricky for brands. Influencers today have simplified this process by enabling targeted marketing that feels organic.”

Reels rule the roost

Across all three brands, short-form videos deliver the highest engagement rates. Swiggy Instamart dominates this format with an impressive 6.90% engagement rate on reels, followed by Zepto at 5.53% and Blinkit at 4.91%. While static images and carousels still have their place, the stats speak loud and clear: reels are where the magic happens.

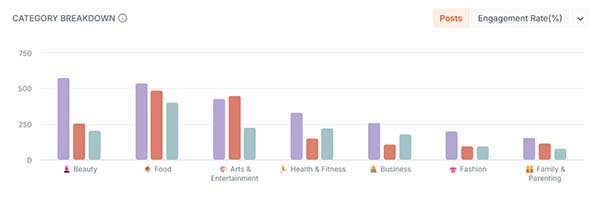

Each platform has carved a unique niche in content categories. Swiggy Instamart leads in food-related posts, with a 3.14% engagement rate that’s as delicious as the meals it delivers. Zepto shines in arts and entertainment, achieving an outstanding 8.09% engagement rate, reflecting its knack for tapping into creative, lifestyle-driven content. Blinkit, meanwhile, aligns itself with the growing wellness wave, boasting a 2.69% engagement rate in health and fitness.

Source: Qoruz (Blinkit- purple, Swiggy Instamart-red, Zepto-Green)

Swiggy CEO Rohit Kapoor highlights the power of influencers and meme stars in driving engagement. “10 million organic views in just 24 hours and 1 million shares—this was the craziest and most viral reel by Swiggy, following the iconic Juhi Chawla campaign,” he said, referencing their success on Instagram.

When it comes to sheer social media activity, Blinkit sets the pace with 2.7K posts, showcasing its intent to dominate the conversation. Swiggy Instamart follows with 1.8K posts, while Zepto, despite posting only 1.5K times, proves that it’s not about quantity but quality.

Zepto edges ahead with an impressive engagement rate of 2.89%, narrowly beating Swiggy Instamart’s 2.87%. Blinkit, despite its higher post volume, lags behind at 2.26% engagement—a gap that underscores the significance of content resonance over mere frequency.

In terms of share of voice, the results reveal intriguing dynamics. Blinkit’s posts generated 9.9 million engagements, yet Swiggy Instamart stole the show with 15.1 million interactions from fewer posts. Zepto, with 6.7 million engagements, illustrates the power of focused, high-impact content.

With the rapid growth of the quick commerce sector and its expansion into services beyond consumable goods—such as ambulances and specialised offerings—influencers will continue to play a pivotal role in driving awareness and adoption.

Krisneil Peres concludes, “Their ability to connect authentically with audiences makes them invaluable for promoting new initiatives in this fast-paced industry, especially in Tier II and III cities where quick commerce is still a relatively new concept for many consumers.”