India's SVoD market to grow 30% by 2027 driven by OTT bundling: EY report

JioHotstar likely to be a major driver of this expansion, attracting subscribers with its vast film library and premium sports content, claims the latest EY report

JioHotstar likely to be a major driver of this expansion, attracting subscribers with its vast film library and premium sports content, claims the latest EY report

The growth of India’s Over-the-Top (OTT) entertainment sector is on a fast track, with paid video subscriptions set to rise 30 percent over the next two years, driven by 700 million internet users actively consuming audio and video content.

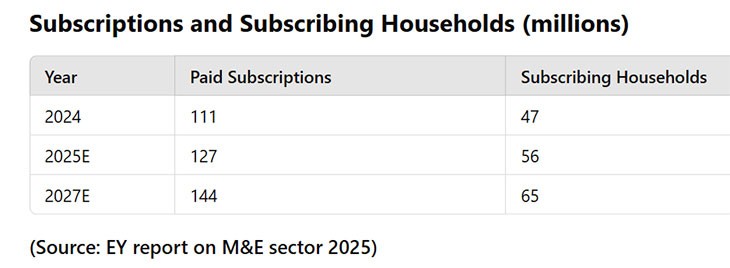

The video streaming landscape is expected to see exponential growth, with the number of subscribing households increasing from 47 million in 2024 to 65 million by 2027, according to the latest FICCI-EY report, "Shape the Future," released today in Mumbai.

This expansion will push total paid subscriptions to 144 million, up from 111 million in 2024—a nearly 30% increase. On average, each household will have 2.2 subscriptions.

Industry experts attribute this rise to the increasing bundling of OTT platforms by Internet Service Providers (ISPs) and telecom operators.

Notably, Bharti Airtel on Wednesday announced the launch of its Internet Protocol Television (IPTV) services in India with an extensive library of on-demand content from 29 OTT apps such as Amazon Prime Video, Apple TV+ and Netflix. Similarly, Jio and Vi also offer more than a dozen streaming apps with their plans.

“This strategy mirrors the role previously played by Distribution Platform Operators (DPOs) in the television sector. However, ensuring consumer choice in selecting bundled platforms will be critical to sustaining long-term growth,” the report noted.

Jiohotstar likely to rule the game

JioHotstar is anticipated to be a major driver of this expansion. As one of the most ubiquitous "first subscription pack" platforms, its extensive library of films and premium sporting events will play a crucial role in attracting new subscribers. The success of its pricing strategy, particularly around marquee sporting events like the Indian Premier League (IPL), will be a defining factor, reads the report.

Kevin Vaz, Chief Executive Officer - JioStar - Entertainment Business TV & Digital, says, “Rapid consumer-tech adoption has allowed streaming to blossom alongside TV. Streamers have taken bold business model risks and offer hybrid and competitive service formats, democratising consumption.”

“This has deepened investments in niche content, granted independent filmmakers and performers an avenue to showcase their talent and fostered the adoption of emerging tech like AI,” he shares.

Diversification needed in content strategy

While crime and action genres currently dominate, accounting for over 60% of content, platforms will need to diversify to appeal to a broader audience. There is an increasing demand for content that caters to women, youth, and the elderly.

Industry watchers predict a rise in new genres by 2025 and 2026, ensuring a more inclusive content strategy.

Freemium model is the way forward

There is still a large number of consumers who do not want to pay for content. Streaming platforms are trying every bit to capture this group of “unwilling” customers.

For instance, Netflix launched its ad tier in 12 countries in 2023, which drove 6 per cent of subscriptions and 1 per cent of extra ad revenue. Almost all major SVoD services have an ad tier now.

“A hybrid OTT offering, both AvoD and SvoD, is the way to expand further. At over $200 billion, online video advertising is the top source of revenue for the global media and entertainment business,” industry experts say.

The push towards "freemium" models – a combination of free and premium content – is also expected to accelerate. However, India's relatively low digital ad rates remain a challenge and will need to be addressed for sustainable revenue growth, the report noted.