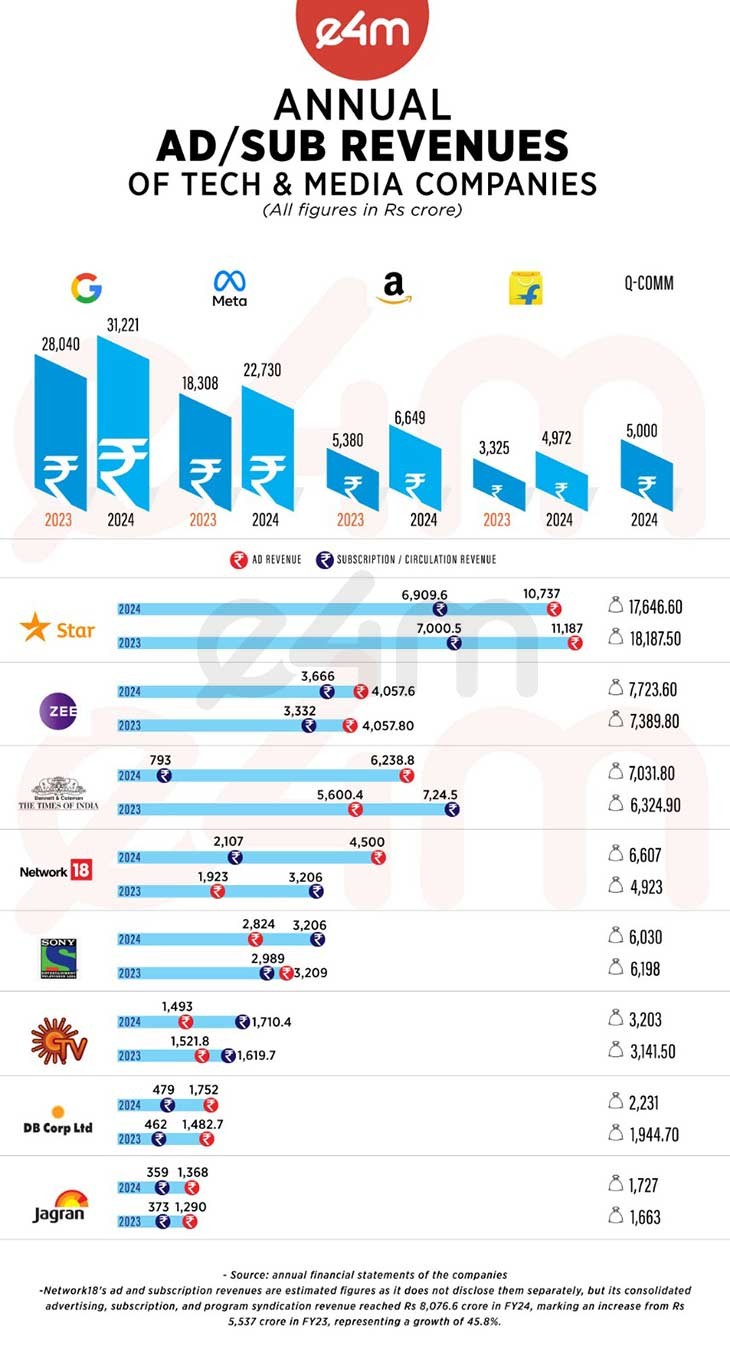

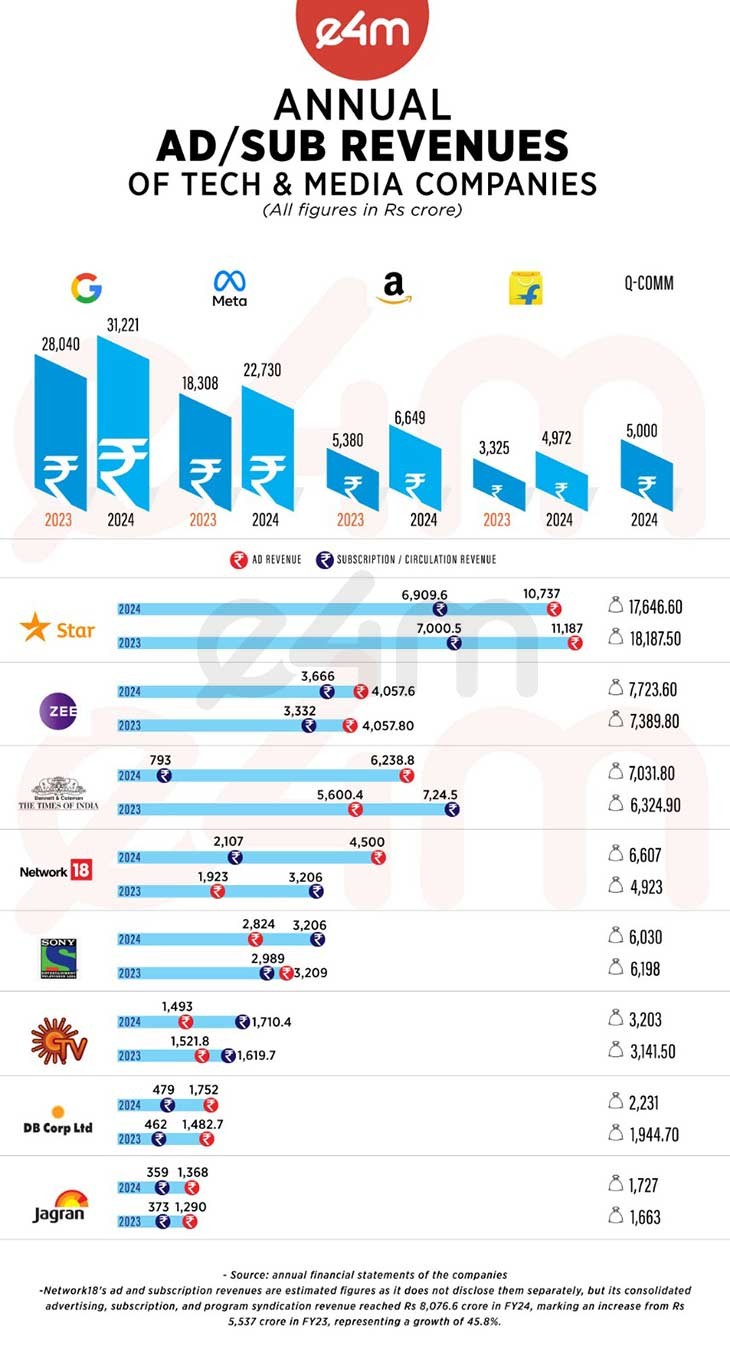

In FY 2024, subscription revenues across major media companies demonstrated steady and consistent growth, outpacing the more volatile performance of advertising revenues.

While advertising remains the primary revenue driver for most companies, the data highlights significant fluctuations in ad income, with some businesses facing decline or stagnation. In contrast, subscription revenues have emerged as a more reliable and stable source of growth, showcasing their resilience amid shifting market dynamics.

For instance, Sony Pictures Networks India (SPNI, now Culver Max) experienced a decline in ad revenue by 12%, dropping from Rs 3209 Cr in 2023 to Rs 2824 Cr in 2024, but its subscription revenue increased by 7.3%, from Rs 2989 Cr to Rs 3206 Cr. In FY24, it posted Rs 6,030 crore total revenue, with subscription (Rs3,206 crore) outweighing ad revenue (Rs2,824 crore).

A similar trend is observed with Zee Entertainment Enterprises Ltd (ZEEL), which grew to Rs 7,723.6 crore revenue, with a balanced contribution from ad (Rs 4,057.6 crore) and subscription (Rs 3,666 crore) revenues. While its ad revenues remained stagnant at approximately Rs 4057 Cr, the subscription revenue grew by 10%, increasing from Rs 3,332 Cr to Rs 3,666 Cr.

Sun TV followed a related pattern; its ad revenue dropped slightly by 1.9%, but subscription revenue increased by 5.6%, suggesting resilience in recurring revenue streams.

On the other hand, companies such as Star India struggled with both ad and subscription revenues, with ad revenue decreasing by 4% and subscription revenue falling by 1.3%. In FY 2024, Star India retained its top position with Rs 17,646.6 crore combined revenue, despite a slight dip in both ad (Rs 10,737 crore) and subscription (Rs 6,909.6 crore) revenues year-on-year.

Network18 witnessed significant growth in FY24, with its total revenue rising to Rs 6,607 crore, a sharp increase of Rs 1,684 crore from Rs 4,923 crore in FY23. The company’s ad revenue surged to

Rs 4,500 crore in FY24 from Rs 3,000 crore in FY23, marking a robust growth of Rs 1,500 crore, driven by strong advertising demand. Subscription revenue also grew to Rs 2,107 crore from Rs 1,923 crore, reflecting a modest increase of Rs 184 crore. This indicates that while advertising remains the primary growth driver for Network18, subscription revenue is also showing steady upward momentum, contributing to the overall positive performance.

BCCL experienced healthy growth in ad revenue (11.4%) and TV subscription/distribution revenues (9.4%), reflecting strong performance across its diversified businesses. Its combined ad and subscription revenue stood at Rs 7,031.8 crore, showing strong growth driven by ad revenue (Rs 6,238.8 crore).

On the other hand, Jagran Prakashan reported modest ad revenue growth of 6% but faced a slight decline of 3.7% in circulation revenue, highlighting some challenges in maintaining its circulation base.

DB Corp, however, showcased impressive ad revenue growth of 18.2%, while circulation revenue grew moderately by 3.7%, indicating overall steady growth.

DB Corp and Jagran recorded lower totals at Rs 2,231 crore and Rs 1,727 crore, respectively, with both relying heavily on ad revenues—Rs 1,752 crore for DB Corp and Rs 1,368 crore for Jagran.

Advertising revenues have exhibited more mixed results, with some companies reporting significant growth while others facing declines.

Tech-driven giants like Google, Meta, Amazon, and Flipkart demonstrated impressive ad revenue growth, reflecting the strong demand for digital advertising. Google grew its ad revenue by 11.1%, from Rs 28,040 Cr in 2023 to Rs 31,221 Cr in 2024.

Meta reported a sharp 24.2% rise in ad revenue, increasing from Rs 18,308 Cr to Rs 22,730 Cr, while Amazon and Flipkart reported remarkable growth of 24% and 50.3%, respectively.

Flipkart's ad revenue increase, from Rs 3325 Cr to Rs 4972 Cr, underscores the boom in digital commerce and targeted advertising. In contrast, legacy media companies like Sony and Star faced challenges in their ad revenue streams, likely due to shifts in advertiser preferences and market conditions.