Can govt-run WAVES compete with private streaming giants?

Prasar Bharati’s free OTT platform has witnessed over 30 lakh downloads so far. While the platform has potential, consumers and experts feel its content strategy needs strengthening

Prasar Bharati’s free OTT platform has witnessed over 30 lakh downloads so far. While the platform has potential, consumers and experts feel its content strategy needs strengthening

.jpg)

As India’s streaming industry continues to boom, the government-backed OTT platform WAVES is striving to carve a niche. After four months into its launch, the platform has seen over 30 lakh downloads and a daily viewership of about a lakh, raising questions about its long-term viability.

Given India’s massive digital population of 80 crore and WAVES being a free-to-access platform, industry experts believe the current subscriber base and engagement levels fall far short of expectations.

Notably, YouTube leads the Indian OTT market, attracting a massive 41 crore unique visitors across desktop and mobile platforms in December 2024. This is followed by MX Player (9.9 Cr) now Amazon MX Player, Spotify (9.1 Cr), HotStar (8.9 Cr), and JioCinema (7.2 Cr), according to Comscore’s latest report “India Year in Review 2024: Setting Stage for 2025”.

Launched by public broadcaster Prasar Bharati on November 20 at the 55th International Film Festival of India (IFFI), WAVES is positioned as a unique offering aimed at catering to the rising demand of digital content. The free OTT app is intended to bridge the digital media and entertainment divide, on the back of its collaboration with BharatNet for last mile connectivity to rural audiences.

The platform promises to be an aggregator offering a mix of classic and contemporary content, in over a dozen languages, along with free-to-play gaming, radio, live TV, and even online shopping via the ONDC-supported e-commerce platform.

Content strategy needs to be strengthened: Experts

Industry experts suggest that a more robust slate of original content could significantly enhance the platform’s appeal. Its slate of original series and films remains significantly smaller than global players like Netflix and Prime Video, sector experts say.

“WAVES do have some Originals, both shows and movies, but most of the content has been borrowed from Doordarshan and other channels which have little appeal among Gen Z and Y. Besides, their user interface needs little improvement,” said Abhishek Rege, Founder of Aarambh Entertainment.

WAVES’ biggest challenge is competition from established players who invest heavily in premium content and technology. They have a huge content library and multiple collaborations. They declare their annual content slate in advance which creates enthusiasm.

“With several OTT platforms vying for viewer attention in the country, Prasar Bharati must significantly strengthen its content strategy to establish itself as a preferred entertainment destination. Today’s OTT audiences actively seek compelling storytelling and are accustomed to subscribing to multiple platforms to consume fresh and immersive content,” Rege noted.

Given the popularity of OTT shows like Panchayat, Aashram, and Mirzapur, as well as latest dubbed South Indian and international films on private streaming platforms, today’s audiences have come to expect high-quality, engaging content—an expectation WAVES has the opportunity to meet as it evolves.

Big advertisers will surely explore WAVES once it starts investing in originals like DD did when it produced serials like Mahabharat and Ramayan.

Sayak Mukherjee, Founder at Brandwizz & Creatorcult Media, added, “To stay relevant in today’s content ecosystem, WAVES must prioritise the creation of original programming. The type of content that resonates on OTT platforms is not something Prasar Bharati is currently equipped to produce.”

According to Mukherjee, if the focus is purely on driving numbers, there’s a clear opportunity in rural-centric content—areas where the government can genuinely generate significant traction.

"However, the real differentiator lies in consistently delivering fresh, engaging content that offers something beyond what’s already available on YouTube. Presently, much of the platform’s library comprises legacy Doordarshan and CBFC material, which is already accessible elsewhere online", Mukherjee noted.

Content budget

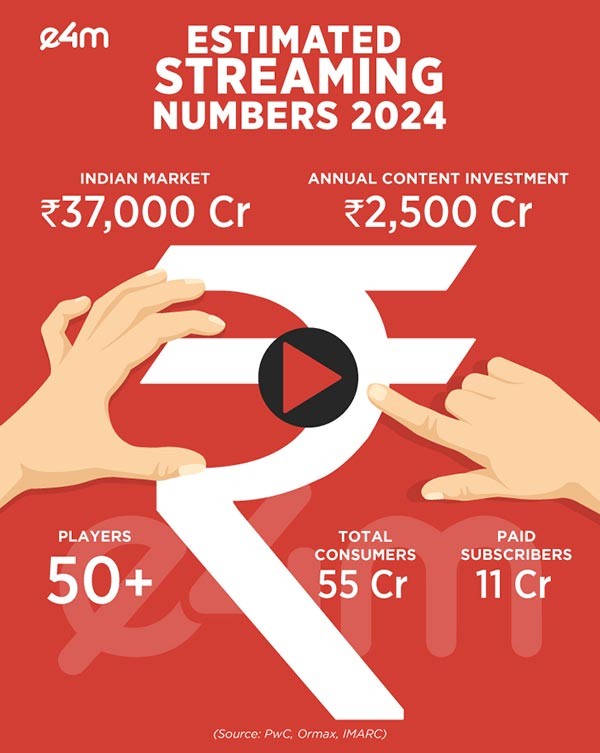

Leading streaming platforms, which includes Netflix, Prime Video and MX Player, Hoststar, Zee5 and SonyLiv, invested cumulatively over Rs 2,500 Cr in 2024 in content production and acquisition, several production houses and studio heads told e4m.

Each of these platforms commission 50-60 web series and films and acquire digital rights to dozens of blockbuster movies every year.

Netflix, for instance, made 10 web series in 2024. The number of licensed films was 55 in this period, though it produced more original films this year (14) than the last year (10). Amazon Prime Video released its content slate for the year in March with over 40 Original series and movies, and 29 of some of India’s “biggest and most anticipated movies”.

There is no clarity over Waves’s content budget and content slate so far.

An MIB press communique issued after a week of its launch stated, “Under its notified Content Acquisition Policy 2024 for acquiring content for WAVES, Prasar Bharati has curated a strong content lineup of content to satisfy diverse tastes of subscribers in all age groups across urban, metros, middle India and NRI audiences who seek Indian / regional / International viewing experience,”

“As a conscious step to unlock the potential of young creators in the creative economy, WAVES also offers its platform to content creators like the National Creator Awardees. WAVES has opened its portal to student graduate films, and some initial film and media colleges to partner on WAVES are FTII, Annapurna, AAFT,” the November 29th release further stated.

Central government ministries and states have also joined hands with Prasar Bharati to co-develop or contribute varied content such as docudramas, dramatized or fictionalized shows, reality shows with entertainment value, as an effective vehicle for meaningful messages. This includes a documentary on the 75th anniversary of the Hon’ble Supreme Court of India, cyber security awareness with CDAC MeitY, the NFDC archives Cinemas of India among others, the MIB said then.

Brand clarity

Positioned as a cultural showcase for Indian cinema, documentaries, and regional storytelling, Waves as a platform seeks to promote homegrown content and act as a bridge between India and the global diaspora. However, even as it looks to establish its identity, there’s a growing chorus of concern around its branding clarity.

WAVES is also the abbreviation for the government’s World Audio Visual and Entertainment Summit — a B2B initiative to bring together global stakeholders from the media and entertainment industry. The simultaneous usage of “WAVES” for two very different verticals — one consumer-facing and the other industry-centric — has raised eyebrows among brand strategists and media experts.

"Brand equity is built on clarity and recall. Using the same acronym for two arms of the same ecosystem may dilute messaging and cause long-term confusion,” says a senior marketing executive associated with OTT branding.

Compulsions of the public broadcaster: Prasar Bharati

Apart from a lack of youth-focused content, an unclear target audience is making it hard to stand out in a crowded market, experts say.

Gaurav Dwivedi, CEO of Prasar Bharati, acknowledges the constraints but remains optimistic about WAVES’ growth trajectory. “Unlike other OTT services, Waves doesn’t have any target audience. Our audience is the entire India. Hence, getting the content which can appeal to everyone would be a challenge.”

He also emphasizes the necessity of a public broadcaster’s presence across all content formats. “If audiences are looking for video content and we are taking only audio, then we are not really matching their expectations. So, having our own platform is a necessity for us to take news, information, and entertainment to audiences across the country.”

Unlike commercial OTT giants, WAVES follows a public service model, which means maintaining a low entry barrier and avoiding high subscription fees. “It’s a case of balancing the public service mandate with commercial operations, and we will strike a balance as time goes by. It’s only been four months and the number of daily active users is showing a rising trend, currently at 1.5 lakh,” Dwivedi states.

The platform is banking on an ad-supported model, aligning with market trends. “The FICCI report highlights how a greater portion of ad spend is shifting to digital. To monetize our operations, we need to strengthen our digital presence,” he notes.

Opportunities

India is the world's fastest-growing OTT market and has reached Rs 17,500 in 2023 and is estimated to double by 2028 at a compound annual growth rate (CAGR) of 14.9 per cent, according to a PwC report.

Even paid video subscriptions are projected to grow 30% in two years, fuelled by 800 million internet users consuming rich audio-visual content, according to the FICCI-EY report Shape the Future.

Experts believe this growth presents a golden opportunity for Prasar Bharati to position WAVES strategically.

With the right budget allocation and smart content curation, WAVES could gain traction quickly—especially if bundled with BSNL. “If the content offering is window-dressed aptly and served to the right audience, govt-run OTT platforms will surely eat into a certain amount of market share,” says Pep Figueiredo, COO - PTPL India and ex-SonyLIV.

To compete with private players, WAVES must invest in content delivery networks, UI upgrades, and showcasing. Experts highlight its unique edge—free access, government backing, and integration with in-house DTH services—as tools to bridge existing market gaps. Legacy shows and mythological content could tap into nostalgia-driven audiences.