Ad land: Omnicom leads globally, IPG stands tall in India

The contrasting scales of Omnicom & IPG groups in India versus their global performance highlights that India’s unique market requires tailored approaches that go beyond global playbooks

The contrasting scales of Omnicom & IPG groups in India versus their global performance highlights that India’s unique market requires tailored approaches that go beyond global playbooks

.jpg)

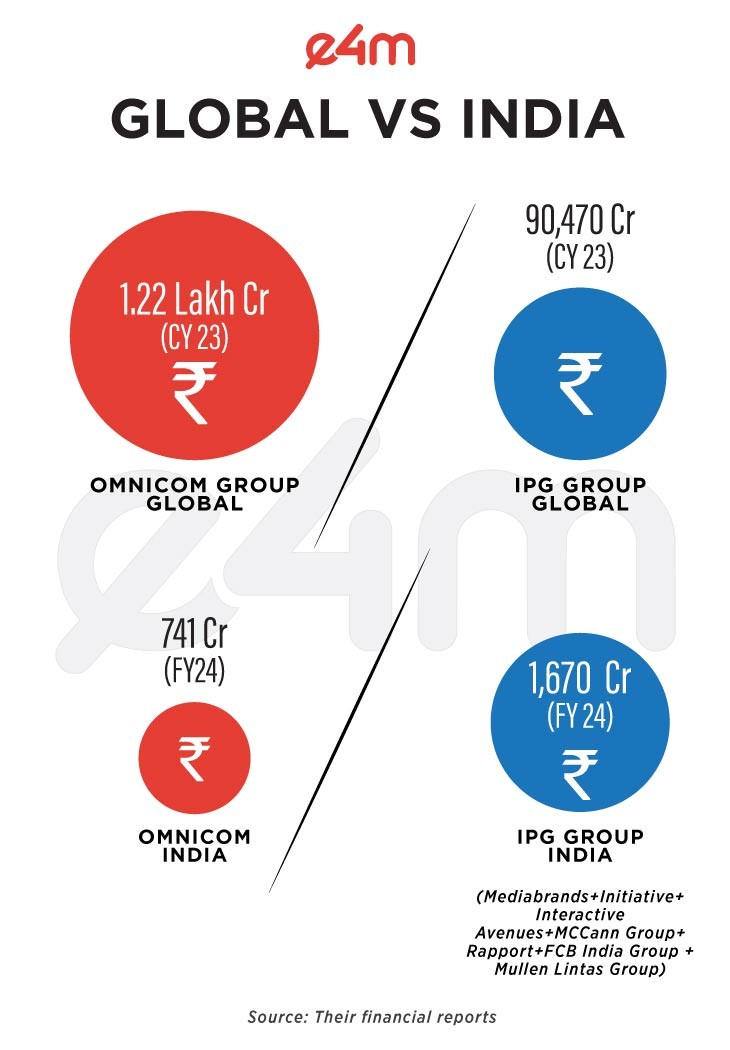

Omnicom and Interpublic Group (IPG), two of the largest global advertising networks, present a fascinating study of contrasts when comparing their global and Indian operations. While Omnicom dominates globally, IPG outperforms Omnicom in India, highlighting a disparity between their international and regional scales.

According to financial reports for the calendar year 2023, OMG stands as the larger of the two groups globally:

Omnicom ’s global revenue is approximately 35% higher than IPG’s, reinforcing its position as a dominant player in the global advertising market.

Indian Market: A Different Story

However, the dynamics flip in the Indian market, where IPG’s scale surpasses that of Omnicom, as per their financial reports obtained from Tofler.

(*includes Mediabrands+Initiative+Interactive Avenues+MCCann Group+Rapport+FCB India Group + Mullen Lintas Group)

IPG India’s revenue is more than double than Omnicom India’s, underscoring its stronghold in the region. This significant gap points to IPG’s deeper penetration and stronger client base in India.

“The stark difference in their standings can be attributed to several factors. Firstly, IPG’s agencies, such as Mediabrands, have established a robust presence in India over the years, catering to a diverse range of clients and industries. Besides, IPG India manages several high-profile accounts, giving it a competitive edge in terms of revenue and market influence,” say industry experts.

On the other hand, Omnicom’s global strength lies in its advanced media technologies and integrated solutions. However, its relatively smaller scale in India indicates room for growth in localizing its strategies to better align with regional market dynamics, say the experts.

e4m reached out to both holding companies but they declined to comment.

In terms of billing

GroupM, WPP’s media investment arm, remains the unrivalled leader in the Indian market even after the merger of Omnicom and IPG groups, data from Comvergence, an independent research bureau tracking agency performance, highlights. As per their statistics:

Omnicom’s current billing in India is estimated at $500 million. Even with the combined strength of Omnicom and IPG groups, their consolidated billings reach only $2.5 billion.

The contrasting scales of Omnicom and IPG groups in India versus their global performance highlights that India’s unique market characteristics require tailored approaches that go beyond global playbooks.

“For Omnicom, the challenge and opportunity lie in scaling up its operations to capture a larger share of the Indian market. For IPG, the task is to maintain and build on its stronghold while leveraging its Indian success to fuel further global growth,” say senior ad executives.

As the Indian market continues to grow, the dynamics between these two global giants will be worth watching, as both groups seek to capitalize on one of the world’s most vibrant advertising landscapes.