FY2025: Mixed outcomes for India’s top broadcasters?

The financial performance in FY2025 reflects the ongoing challenges in the TV news business, exacerbated by macroeconomic pressures and shifting advertising trends

The financial performance in FY2025 reflects the ongoing challenges in the TV news business, exacerbated by macroeconomic pressures and shifting advertising trends

.jpg)

India’s leading television news networks, Zee Media, Network18, and NDTV, have posted a mixed financial performance in FY2025 compared to the previous fiscal. While NDTV witnessed a strong rise in revenues amid strategic expansion, Network18 and Zee saw contractions in top-line performance.

All three players, however, slipped deeper into losses, reflecting the ongoing challenges in the TV news business, exacerbated by macroeconomic pressures and shifting advertising trends.

Revenue from operations: Stable yet shaky situation

Revenue from operations saw varied trends across the three broadcasters. NDTV reported the strongest year-on-year growth, with its revenue rising to Rs 465.03 crore in FY25 from Rs 370.01 crore in FY24, a jump of over 25%.

Zee Media’s revenue from operations declined slightly to Rs 621.91 crore in FY25 from Rs 638.29 crore in FY24, marking a drop of about 2.6%. A closer look at the composition reveals that advertising revenue fell 3.8% to Rs 576.56 crore from Rs 599.65 crore, while subscription revenue rose 16.4% to Rs 44.73 crore from Rs 38.42 crore.

Network18 posted the steepest decline, with operating revenue shrinking to Rs 6,887.92 crore in FY25 from Rs 9,297.45 crore in FY24, a 25.9% fall. The company attributed this sharp drop partly to a challenging advertising environment. As per the broadcaster, the overall advertising inventory consumption for the TV news industry declined by 15% year-on-year, putting additional pressure on revenue growth for the sector.

The broadcasting giant also mentioned that the operating revenue of its news business for the year was Rs 1,896 crore, 4.3% higher YoY, despite the soft advertising environment persisting through the year. This was led by growth in ad pricing, which the network has been able to drive on the back of strong viewership shares across multiple markets. Given the recent improvement in ranking/share in Marathi, Bengali, and Kannada markets, there is potential for further growth. EBITDA for the year improved marginally as operating costs grew only 3.5% for Network18.

Total revenue soars for some, sinks for others

NDTV continued its upward trajectory with total revenue reaching Rs 472.18 crore in FY25, compared to Rs 392.72 crore in FY24, an increase of 20.2%. This growth was underpinned by the broadcaster’s strategic push into regional and international markets.

During the year, NDTV launched NDTV Marathi and NDTV World. The network also debuted initiatives like the NDTV World Summit, an IP aimed at convening global thought leaders.

Zee Media’s total revenue declined to Rs 632.97 crore from Rs 663.03 crore, marking a drop of 4.5%. Network18 saw a more significant fall of 26.4%, with total revenue declining from Rs 9,994.42 crore in FY24 to Rs 7,358.57 crore in FY25. Experts suggest the latter’s performance reflects broader headwinds in the TV ad market and a general slowdown in the media sector’s monetisation cycles.

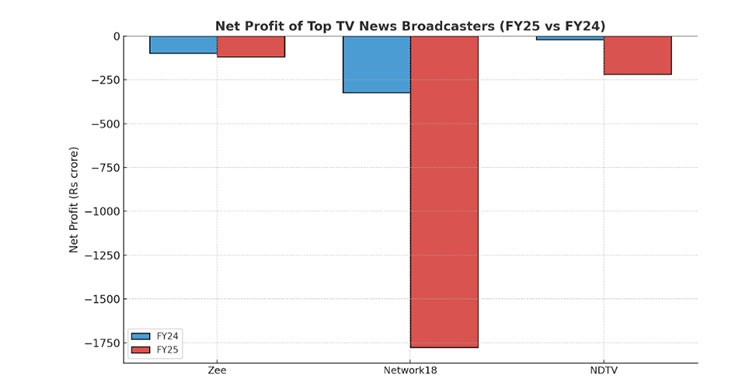

Profitability takes a nosedive

Despite efforts at expansion and diversification, all three networks remained in the red in FY25, with widening losses across the board.

NDTV reported a net loss of Rs 218.01 crore, up significantly from Rs 21.35 crore in FY24. The company attributed this to deliberate investments made during the year to strengthen its long-term capabilities. Commenting on the performance, Sanjay Pugalia, Executive Director and Editor-in-Chief of NDTV, said, “FY 2024-25 was a defining year for NDTV, one where we chose to lead with ambition and invest in the future. From expanding our regional and global footprint to deepening our digital presence, we have laid the foundation for a more agile, inclusive, and future-ready network.”

Zee Media’s losses also deepened to Rs 119.42 crore from Rs 98.43 crore the previous year.

Network18 posted the largest loss of all three, reporting a net deficit of Rs 1,776.67 crore in FY25, up from Rs 324.59 crore in FY24. Despite the challenging financials, the company remained optimistic about its long-term trajectory. Adil Zainulbhai, Chairman of Network18, noted, “We are really happy to end the fiscal on a strong note as the largest news network in the country on all fronts- viewership share, audience reach and language footprint... I am positive about the long-term growth of the company despite the macroeconomic headwinds that the world faces in the short term.”

Look ahead

The financials for FY25 underline the turbulent conditions India’s TV news broadcasters are navigating. While NDTV showed promising revenue growth through strategic investments in regional and global platforms, it came at the cost of short-term profitability. Zee Media and Network18, on the other hand, grappled with falling revenues and growing losses amid a tough advertising environment.

As the media landscape continues to evolve, the coming fiscal will test the agility and adaptability of legacy broadcasters in a rapidly digitising world.