Auto advertising races ahead in 2024: Two-wheelers lead the charge

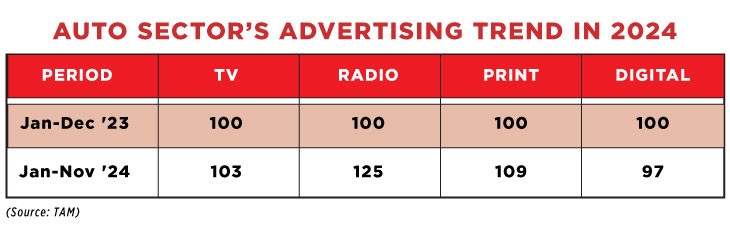

While Print demonstrated 9% increase, Television showed a growth of 3%. Radio experienced the highest growth of 25%, according to TAM data shared exclusively with e4m

While Print demonstrated 9% increase, Television showed a growth of 3%. Radio experienced the highest growth of 25%, according to TAM data shared exclusively with e4m

.jpg)

Despite the industry going through a slowdown, India’s auto sector maintained robust advertising activity in 2024, with Print and Radio showing significant growth compared to the previous year, according to TAM data, shared exclusively with e4m.

While Print media demonstrated a steady increase, growing by 9%, Television showed modest growth, with its index climbing by 3% to 103, compared to 2023 and 2024 (data drawn till Nov 2024), figures say. Radio experienced the highest growth, with a 25% increase in its index value. Digital media, however, saw a slight decline, with its index dropping by 3% to 97, reflecting a potential shift in audience preferences towards traditional media channels like radio and print.

This sustained advertising investment by the auto sector comes despite a series of subdued quarters and pilling of stocks, and a broader slowdown in the advertising and media industry due to subdued consumer demand and inflation. Most of the FMCG brands, the top spender, had even curtailed their advertising expenditure to sustain.

No wonder that vehicle retail sales in India grew by 9 per cent in 2024, reaching a record of nearly 26.1 million units and surpassing the pre-Covid peak of 25.4 million units set in 2018, thus, in the process, finally marking a full recovery from the pandemic-induced slowdown.

This milestone follows two consecutive years of double-digit growth, with sales climbing from 24 million units in 2023. Data from the VAHAN portal (Ministry of Road Transport and Highways) showed that total new vehicle registrations were 24.16 million in 2019, 18.6 million in 2020, 18.9 million in 2021, and 21.5 million in 2022.

Interestingly, the ad volume of the auto sector appears to be driven largely by two-wheelers. TVS Motor Company and Honda Motorcycles were the top two advertisers of the sector, commanding 25 percent of the ad volume together in 2024, as per the TAM data.

A year ago, their share was merely 15 percent. Top two-wheeler brands, including TVS, Honda Motorcycles, Yamaha, Bajaj, HeroMotoCop, had covered over 40 percent share in the ad volume.

Meanwhile, the ad volume share of Maruti Suzuki slipped from 12 percent to 7 percent this year.

Marketing strategy

The auto sector is the third largest advertiser in the country after FMCG and e-commerce. The segment accounted for about Rs 4,900 crore of AdEx in 2023, out of overall Rs 1 lakh crore expenditure, says Pitch Madison Annual Report 2024. More than half of it, that is around Rs 3,000 crores, comes from carmakers only who spend across media platforms for different target audiences and objectives.

Vivek Srivatsa, Chief Commercial Officer, Tata Passenger Electric Mobility, told e4m, "The automobile industry has experienced significant growth in recent years, while moderation was expected, the demand for vehicles continues to remain strong. In response to this sustained demand, we closely monitor our marketing mix.”

Srivasta added, “Digital platforms, including influencers, have been the key drivers of our outreach, complemented by print and TV, which played a key role in shaping our campaign strategy for the past year, and will continue to do so moving forward.”

Anil Solanki, Media Lead, DentsuX. He noted, “The auto sector’s innovative strategies have finally delivered the results it had been anticipating. By embracing advanced technologies, targeted marketing, and consumer-centric offerings, the industry has turned challenges into opportunities, paving the way for sustained growth.”

“This is a clear indication of shifting consumer aspirations and the increasing accessibility of mobility solutions. As brands continue to innovate with technology and sustainable practices, this momentum highlights the evolving role of the automotive industry in shaping lifestyles and economies alike,” Solanki adds.

A significant part of auto ad spend usually revolves around new launches, which are planned much in advance. However, in 2024, the sector’s marketing strategies predominantly centered on promotional offers designed to clear inventory, sector experts noted.

Avik Chattopadhyay, a brand strategy, marketing, and automotive product planning expert and the founder of Expereal, explains, “The auto sector's growth in 2024 was fuelled by two primary factors: the passenger car/SUV segment witnessed multiple new product launches across brands, and the two-wheeler segment experienced a much-needed revival after 2018, driven largely by e-commerce and q-commerce fleet demand.”

“A significant portion of auto sector advertising in 2024 was driven by promotions and festive offers. At one point, the network pipeline bulged to nearly 700,000 vehicles in stock, prompting brands to aggressively leverage traditional media like print and television to push inventory from stockyards. The festive season became a battleground for outshouting competitors, with advertising efforts focused more on tactical promotions than on long-term brand building or new product announcements,” he pointed out.

Chattopadhyay noted that electric vehicle brands stood out as an exception, focusing instead on product launches and campaigns highlighting innovation.

Muted growth expected in 2025

Industry experts, however, predict a subdued 2025: Passenger vehicle (PV) sales are expected to grow in low single digits, two-wheeler sales are projected to rise by 6-8 per cent primarily due to a slower projected growth of GDP.

“Despite some growth drivers in 2024, overall consumer sentiment remained subdued, leaving little optimism for 2025”, says Chattopadhyay.