Advertiser Artificial intlligence Meta Ads AI tools

Digital AdEx sees 21% growth in 2024; TV, Print & Radio decline

Digital AdEx sees 21% growth in 2024; TV, Print & Radio decline

Advertising in India is undergoing a noticeable transformation, with digital platforms steadily gaining prominence. While traditional media channels like television, print, and radio are experiencing a gradual decline in ad spending, digital advertising continues to expand its share of advertiser budgets.

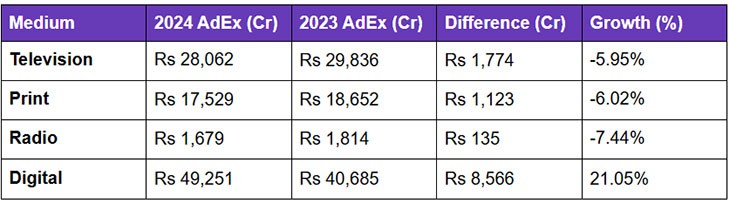

According to the dentsu-e4m Digital Advertising Reports, television AdEx declined by 5.95%, print by 6.02%, and radio by 7.44% in 2024 over 2023. Digital AdEx, however, grew by an impressive 21.05% during the same period.

Relentless enhancement and developments in digital infrastructure are facilitating the rise of digital advertising. These factors have also catapulted the growth of OTT, e-commerce, online payments, social media, gaming and e-sports applications, establishing digital media as the most accessed, utilised and trusted medium among consumers — nudging brands across categories to increase its share of the pie in their annual budgets.

The 2025 edition of the report notes that between 2023 and 2024, television’s share declined from 32% to 28% and is expected to drop further to 24% in 2025. The real estate segment spent 49% of its ad budget on television in 2024, reducing it slightly from 54% in 2023. FMCG was also a key category on television, spending 40% of its ad budget on the medium in 2024, down from 47% in 2023. Consumer durables also saw a dip in the allocation of budgets for television advertising from 44% in 2023 to 37% in 2024.

Print media followed a similar trend, with the share decreasing from 20% to 17% by the end of 2024, with projections suggesting a further decline to 15% by 2025. The government sector spent 73% of its ad budget on print in 2024, down from 79% in 2023. Similarly, the retail sector dialled down its ad spends on print from 58% in 2023 to 52% in 2024. However, the education sector increased its budget for print media from 56% in 2023 to 60% in 2024.

Radio, which maintained a steady share of 2% in 2024, is expected to decline to 1% by the end of 2025, reflecting the shifting dynamics of the advertising landscape. Tourism and retail sectors had both spent 7% of their ad budgets on radio in 2023. However, the share for radio in their respective ad budgets declined to 5% and 6%. The media and entertainment sector continued to spend 5% of the ad budget on radio in 2024 over 2023.

The report predicts that this shift towards a digital-led AdEx will continue, driven by evolving audience consumption habits, technological advancements, and the increasing demand from advertisers for data-driven and personalised advertising solutions. Digital advertising will continue to be the top pick for advertisers focussing on interactive and data-driven platforms to optimise audience engagement and campaign performance. Other mediums most innovate aggressively to catch up and increase their share in ad budgets significantly.

Abheek Biswas, AVP - Consumer Insights, dentsu India says that digital media's rapid expansion underscores the increasing importance of digital channels as the top choice for advertisers. "Print and radio are also losing ground, mainly due to their limited capacity to offer real-time engagement and precise, targeted advertising," he adds.

Biswas further explains the decline in the spends on traditional media: